Okay, I hope that you had a chance to look at your 50/20/30 cash-flow plan that I went over the in the last post. Here’s a reminder about the breakdown:

50% of your monthly income is spent on essentials,

20% of your monthly income is going to savings and debt repayment, and 30 is spent on wants. (For a more thorough breakdown, check out the last post.)

Remember, that it is totally okay if you don’t yet fit within these ratios. Equip yourself with knowledge of your current situation because knowledge is power. We need to know what we are working with to be able to get to where we want to be.

If you are in within these ratios: excellent. If you aren’t yet in these ratios, what I am about to say is simply something to aspire to.

So, here it is! While the 50/20/30 cash-flow plan is solid, I think we can tweak these ratios.

By making some changes, we can become financially independent even sooner.

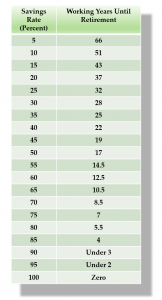

Let’s have a look again at Mr. Money Moustache’s useful Saving Rate Versus Years Needed To Work chart.

As you can see when you look at the chart, if we start saving 30% of our income, we can actually become financially independent 9 years earlier than if we are saving 20% of our income, and 23 years earlier than if we are saving only 10% of our income.

Holy smokes! So, we just have to play this number’s game.

To play this game, we have to question our current lifestyles. Is our large house, our new cars, our annually updated wardrobes and expensive dinners really worth 23 or even 9 years of our life?

What happens if we reduce our essentials to 40% and wants to 20%?

Tweaking the cash-flow plan in this way may require some changes. And sure, change can be challenging. But, wouldn’t this short-term reduction in spending be worth becoming financially liberated 23 years earlier?

For one, do we really even use all the space in their house?

A global survey found that Canadians enjoy the second-most living space per person. On average, we have 618 square feet per person! That’s a lot of room.

When my wife and I first moved into a house, we knew how little we would be using our basement. We talked about how much more beef satay, pad thai, sushi and travelling we could enjoy simply by allowing someone to rent our basement!

So, we rolled up our sleeves and pretended like we knew how to build a basement suite! If you want to test the strength of your marriage, this is an excellent idea—ha ha!

Honestly, we wouldn’t live any other way.

We enjoy the freedom the extra rent provides us, and we have less to clean (bonus!).

Stay tuned for a post specifically on how we structure our basement suites, and how, over time, we actually acquired five properties by moving every year or so. It sounds wild when I write that down. But I am sharing this information because we are totally normal people—we didn’t receive a big windfall or anything. This is doable for you too.

Okay, back to the cash-flow plan.

I LOVE the concept and structure of this plan even if we stick to the original 50/20/30 ratios. It allows us to intentionally spend money in a balanced manner. Whatever your ratios are right now, think about where you would like to be, and start to take steps to get there.

How do we get there?

The hard part is moving from intellectual knowledge to action.

You know this feeling, like when you buy a treadmill (intellectually you know you need to exercise) but what happens? Soon, the treadmill turns into a clothes hanger. If you need some ideas to take the first step with your cash-flow plan, here’s something we did in our household:

- Tracked ALL our expenses. Yes, manually tracking these is the BEST way to gain awareness as to where your money goes.

- As we go through our expenses, we took note of ones that didn’t give us value or fulfillment. Then, if we can, we cut them out. If we can’t cut them, we try to reduce them. Like a basement suite!

- We regularly input our monthly expenses into the Cash Flow Planning to see our ratios (free template coming soon).

- In regard to our desired ratios, we make a 1-year goal, a 6-month goal and 3-month goal and set bi-weekly check-ins. They only need to be 10-15 minutes.

- We automated everything. Once money comes into our accounts, it automatically pays bills, goes to savings and spending.

- Account #1 – Our main account. This is where our income goes and then all our predictable fixed expenses are deducted from here. (E.g. mortgage, taxes, reoccurring payments, utilities, transportation, etc.)

- Account #2 Our savings account. Automate your savings at the beginning of the month. Pay yourself first! If you don’t have enough money, cut/reduce expenses somewhere else: don’t cut money from yourself.

- Account #3 Our grocery Account. Automatically transfer our monthly grocery budget here.

- Account #4 Our “wants” or spending account. Monthly, money is automatically transferred to this account and is linked to our debit card.

- Account#5 Emergency account. Money is automatically transferred into this account for, well, emergencies!

We really like this approach because it simplifies the amount of money we need to manage every month. That can be draining. We only really need to manage account #3 and #4 instead of the whole lot!

Let’s do this!

You seriously have the power to transform your future. When you take what you know and actually follow through with actions, lasting change happens. It’s huge. Knowledge, while important, is only the first step. We need to move forward. So, let’s do this. Let’s get into these ratios if we aren’t there yet, let’s tweak them if we are, and let’s gain financial independence by setting our sights on the future.

I’ll leave you with a prompt.

What is one small action that you can take TODAY to get started? Maybe it’s cancel your cable, maybe it’s meal planning so that you can stick to a grocery budget… whatever it is, taking action is the key,

Shaun

No Comments