That’s right. Free money for your kids. I am not joking… read on.

In the world of personal finance and investing we often hear about “too good to be true situations.”

So, it’s important to be skeptical to avoid falling for a scam or losing money. Of course, this kind of thinking applies to things outside of finance too: we want to make sure we are taking in good, well-researched information and are looking for any biases before we make any kind of decision.

But, you know what, Registered Education Saving Plans (RESPs) really are free money for your kids. Let’s take a look together.

What makes an RESP magic?

At the most basic level, a RESP provides parents with the opportunity to save and invest money for their children’s future education costs.

The money inside a RESP compounds over the years. All taxes on the investment growth are tax deferred – meaning you don’t pay taxes until the money comes out of the RESP. Nice! If you missed last week’s post, we talked about tax deferral and compound growth. (Click here to see post)

Are tuition costs rising?

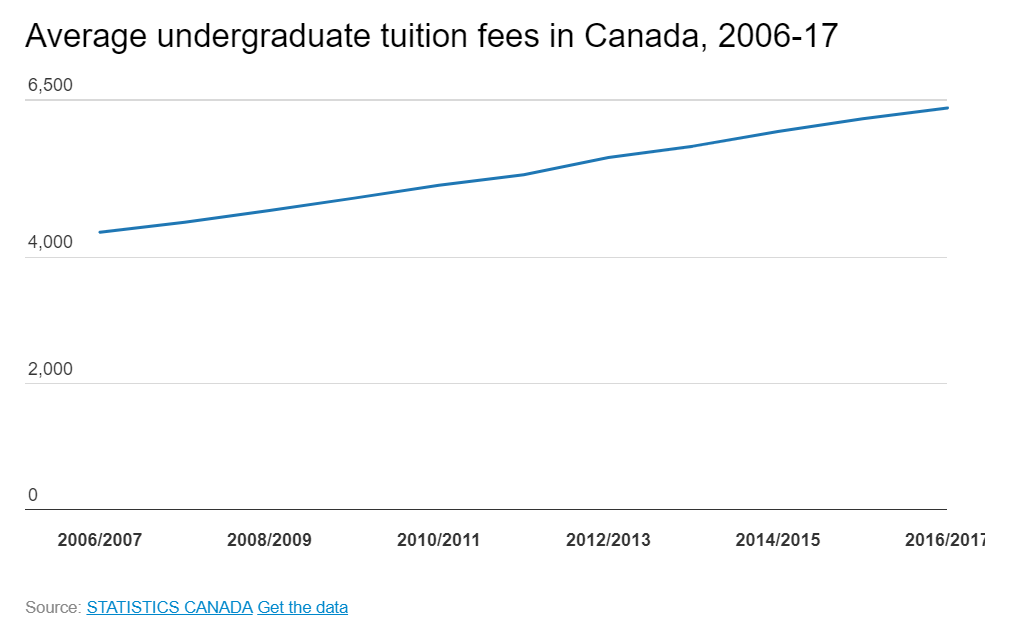

You bet they are! In 2018, according to statistics Canada, an undergraduate degree cost $6,500 a year for tuition alone. According to this study, tuition has been steadily increasing for 28 years.

This makes sense, the cost of chocolate bars have been increasing as well.

But, it’s worth noting that tuition costs have been increasing quite fast. According to Statistics Canada, since 2006, tuition has increased 40%.

Now, there has been many articles written on why tuition is rising and why it shouldn’t etc. We could spend all day looking at those factors. However, despite any politics or other issues involved, we can do our best by being proactive, save early, and use great government programs so the cost of attending a post-secondary institute is not a shock to the bank account.

How do RESPs work?

- They require a “subscriber” the individual who sets up the plan – typically this is the child’s parent. The beneficiary is the child.

- Money invested in the plan grows tax free – so no tax is paid on the growth until it is removed from the plan.

- Then when your child enrolls in a post-secondary education, they can start taking payments, called educational assistance payments (EAPs) from their RESP.

- EAPs are made up of the principle money invested, investment earnings and any government grant money in the RESP.

Here’s where the free money comes!

- The Government has a grant called the Canada Educational Savings Grant (CESG) – your child will qualify for up to $7,200 lifetime contribution until the end of the year they turn 17.

- Basic CESG – The government will match your contributions up to 20% a year or a maximum of $500 a year. So, if you contribute $2,500 a year, you will receive 20% match, which equals $500 of free money ($2,500 * 20% = $500)!

- Additional CESG – Depending on your income, the government may top up your contribution by an extra 10% or 20% on the first $500 of contributions. Click here for details.

- The Canadian Learning Bond (CLB) provides lower-income families with even more free money – check out this link for details (click here).

You can make up to $50,000 of contributions per child into a RESP.

It is important to understand, unlike RRSPs, the contributions made to a RESP are not tax deductible. But you can withdraw your contributions at any time tax free.

Generally speaking, an RESP can stay open for 36 years (under certain circumstances they can be open for 40 years for beneficiaries eligible for the disability tax credit).

Check this out:

I have a 3-month-old baby. If we contribute $2,500 a year (to maximize the CESG grant of 20% or $500 a year) from now until she is 18 years old and take the average cost of an undergrad degree at $6,500 a year, assume 4 years of schooling and assume tuition will increase 6.5% a year……. it would cost approximately $88,000 (over the 4 years). However, our savings would have accumulated approximately $98,000 inside our RESP.

You see, with proper awareness and planning, paying for our children’s university cost can be manageable.

However, we might think to ourselves, should we have our children earn this money in some capacity? Is giving them a fully paid tuition beneficial? Perhaps we can save that conversation for another day!

How to open a RESP:

You can open them at most financial institutions. I find a really simple and easy place to open an RESP is online with Wealth Simple. Wealth Simple is simple and has low fees. Sure, you can find lower fees elsewhere, but for how simple Wealth Simple is, I find they are a great option: https://www.wealthsimple.com/en-ca/.

Canada Child Benefit:

Are you receiving the Canada Child Benefit (CCB)? If so, using the CCB to maximize your RESP can be an excellent option.

If you have a child, why not open an RESP this week? Cut the cable bill, cut back $100 on groceries, and take advantage of this great option available for Canadians.

Shaun

No Comments